How feminists try not to freak out about a possible recession

Part 3: How do feminists do that?

Over the past few weeks, we’ve witnessed Trump’s tariff announcements threatening to destabilise the world economy. Bezos has just sent some famous women into space, burning 75 tonnes of carbon per passenger, in a toxic and false display of feminism*. The world feels like it’s on a knife edge right now. What’s a girl to do when it looks like tariffs and greedy capitalists are coming for our jobs and the economy is spiralling? And does what we wear foreshadow where the economy is headed?

Consider tightening up your spending, from a mindset of saving for a purpose.

Feminist finance blog, Her first $100K, advocates for tightening up spending right now or at least being strategic about expenses. The end game is to build a buffer or emergency savings fund in case something goes wrong, which helps put our minds at ease. I’ve recently been looking at my budget and how to save more. It feels like everything is necessary, but thinking creatively, there are some things I don’t particularly need. A friend (who reads this Substack, hi!) posted about a company doing shitty things like supporting Israel and not paying music artists enough money – I’m looking at you, Spotify. In an article about Ghosting Spotify, writers break down how sometimes a product or service that’s been in your life for several years and has become a default, isn’t actually any good for you or for the people it should be supporting. Thinking creatively about what you really need and what you could live without could save some much needed dollars. Just as we get a dopamine hit from spending money, we can also get a dopamine hit from saving it and watching it accrue.

I’ve just lived through nearly 2 weeks of school holidays with children pestering me to buy things every time we’re out. The necessity of some of these things is questionable (and some experiences have been fun, which makes me want to prioritise these over disposable things). It takes willpower, but cracking away at the emergency savings fund is important when we can’t predict the future.

Thank you for being here. Want to support my writing?

Don’t look at your Kiwisaver balance and do buy stocks ‘on sale’.

Kiwisaver balances have dropped since Trump’s tariff announcements. If you’re young, it’s best to keep your money where it is, so when the market picks up again your investments pick up with it. That way you’re not creating entrenched losses – if switching to a more conservative or balanced fund, when that fund gains, you won’t gain as much. As Her first $100K says, the story is different for older investors or for people where retirement is fast approaching. There should be a plan to shift into more secure funds like bonds, rather than growth funds. (As always, this is general advice and a financial advisor is better placed to know a person’s individual situation**).

I’ve been reading a lot about how shares/stocks are effectively on sale right now as prices have dropped. The only step I’ve taken to benefiting from this is setting up a Sharesies account. The next step is to buy a small number of shares.

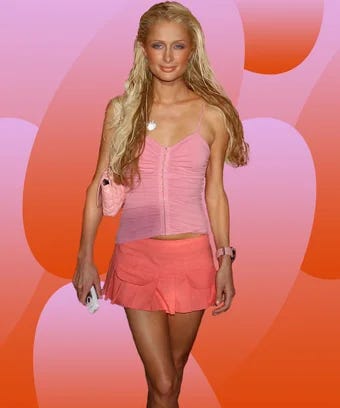

Wear a miniskirt… or sweatpants?

According to the Hemline Index theory, when a recession is on its way, the average length of women’s dresses and skirts is longer, reflecting conservative attitudes. When the economy is heading for a boom and everyone’s feeling good, hemlines start to creep up the leg (think of the 1920s flapper style, or the early-mid 2000s, when I remember wearing miniskirts all the time). This theory has recently been popularised again on social media. However, when you track fashion trends against stock market movements, the two don’t match in this simplistic way (In Style). Instead, it’s a mix of social norms that influence what women wear, and aesthetics are often driven from the inside and how we feel. For example, we might wear comfortable clothes like sweatpants and baggy jumpers when we’re faced with uncertainty, which has been happening for a while during and post-pandemic.

Lipstick sales however, may go up in recession. An article published in a scientific journal suggests that women treat themselves to lipstick as they substitute more expensive items of clothing for a little boost of lip colour (MacDonald and Dildar, 2020). This is still a theory, so who knows. Even if wearing lipstick is an indicator of an economic downturn, we can at least look good while we’re out saving money, investing and preparing for the future.

* with the exception of Amanda Nguyen who conducted research - in less than a minute - before descending back to earth. Her story is incredible.

** The content in this piece is not a replacement for personalised financial advice, from a professional financial advisor.